All Categories

Featured

Table of Contents

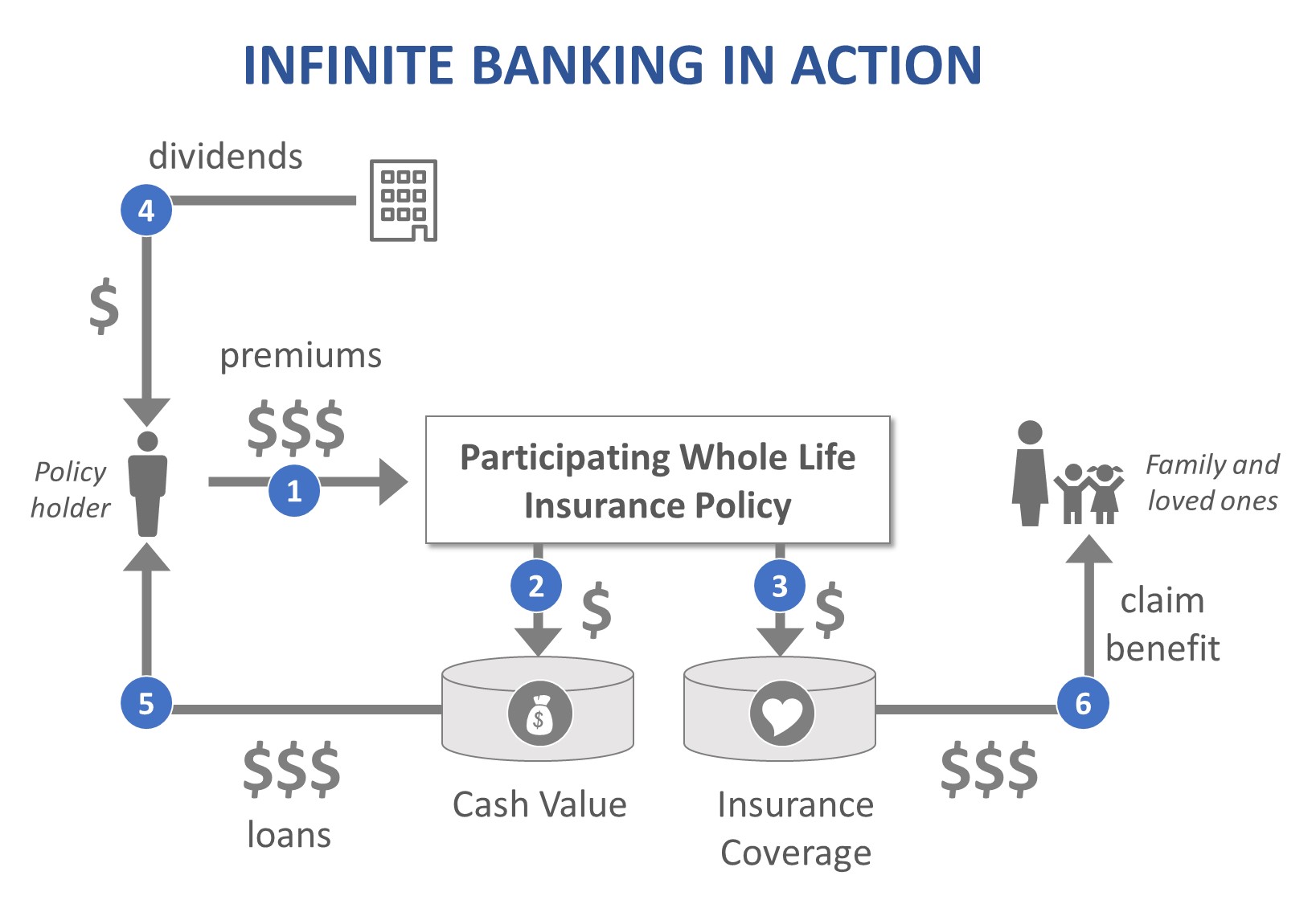

The technique has its very own advantages, yet it likewise has concerns with high costs, complexity, and extra, leading to it being related to as a scam by some. Limitless banking is not the very best policy if you require only the investment part. The boundless banking principle rotates around making use of entire life insurance policy plans as an economic device.

A PUAR enables you to "overfund" your insurance coverage right approximately line of it becoming a Changed Endowment Agreement (MEC). When you use a PUAR, you quickly boost your cash money value (and your survivor benefit), therefore raising the power of your "financial institution". Further, the even more cash money value you have, the higher your interest and returns payments from your insurer will be.

With the rise of TikTok as an information-sharing system, monetary suggestions and methods have located a novel means of spreading. One such technique that has actually been making the rounds is the unlimited financial idea, or IBC for brief, amassing recommendations from celebrities like rap artist Waka Flocka Fire - Private banking strategies. However, while the approach is currently prominent, its origins map back to the 1980s when economic expert Nelson Nash introduced it to the globe.

How can Generational Wealth With Infinite Banking reduce my reliance on banks?

Within these policies, the cash value grows based on a price set by the insurer. As soon as a considerable money value gathers, insurance policy holders can get a cash money value financing. These lendings differ from conventional ones, with life insurance policy functioning as security, meaning one could lose their insurance coverage if borrowing excessively without sufficient cash money value to sustain the insurance expenses.

And while the attraction of these plans is obvious, there are innate constraints and dangers, demanding attentive money value monitoring. The method's authenticity isn't black and white. For high-net-worth people or company owner, specifically those using methods like company-owned life insurance policy (COLI), the benefits of tax obligation breaks and substance growth can be appealing.

The appeal of boundless banking doesn't negate its obstacles: Price: The fundamental requirement, a long-term life insurance policy plan, is pricier than its term equivalents. Qualification: Not every person gets whole life insurance policy because of extensive underwriting processes that can exclude those with certain health or way of living conditions. Complexity and risk: The elaborate nature of IBC, paired with its risks, might prevent several, specifically when simpler and much less risky options are readily available.

What are the tax advantages of Infinite Banking Concept?

Designating around 10% of your regular monthly revenue to the plan is just not feasible for the majority of people. Utilizing life insurance policy as an investment and liquidity resource needs technique and tracking of policy cash value. Seek advice from an economic consultant to figure out if boundless financial lines up with your top priorities. Part of what you read below is just a reiteration of what has currently been said over.

So prior to you obtain into a circumstance you're not gotten ready for, understand the following first: Although the idea is commonly sold therefore, you're not actually taking a lending from yourself. If that were the instance, you would not need to repay it. Rather, you're borrowing from the insurer and need to repay it with rate of interest.

Some social media posts suggest making use of money worth from entire life insurance to pay down credit report card financial obligation. When you pay back the car loan, a section of that interest goes to the insurance coverage business.

Can Bank On Yourself protect me in an economic downturn?

For the very first numerous years, you'll be repaying the commission. This makes it exceptionally tough for your policy to gather worth throughout this time. Entire life insurance policy expenses 5 to 15 times extra than term insurance policy. Many people merely can't manage it. So, unless you can afford to pay a couple of to several hundred bucks for the next decade or even more, IBC will not function for you.

If you call for life insurance, here are some important tips to think about: Think about term life insurance coverage. Make certain to go shopping about for the ideal price.

Cash Flow Banking

Imagine never ever having to stress regarding small business loan or high rate of interest once again. What if you could borrow cash on your terms and develop riches at the same time? That's the power of limitless banking life insurance policy. By leveraging the cash worth of entire life insurance IUL plans, you can grow your riches and borrow money without relying upon typical financial institutions.

There's no set finance term, and you have the freedom to choose the settlement routine, which can be as leisurely as settling the finance at the time of death. This adaptability reaches the maintenance of the car loans, where you can select interest-only repayments, maintaining the funding balance level and convenient.

What financial goals can I achieve with Financial Independence Through Infinite Banking?

Holding money in an IUL fixed account being attributed rate of interest can usually be better than holding the cash on deposit at a bank.: You've always dreamed of opening your own pastry shop. You can obtain from your IUL policy to cover the preliminary expenditures of leasing an area, acquiring devices, and hiring personnel.

Individual fundings can be gotten from standard financial institutions and credit rating unions. Obtaining cash on a credit scores card is typically very pricey with annual portion rates of rate of interest (APR) often reaching 20% to 30% or even more a year.

Latest Posts

How To Train Yourself To Financial Freedom In 5 Steps

Whole Life Insurance Banking

Non Direct Recognition Whole Life Insurance