All Categories

Featured

Table of Contents

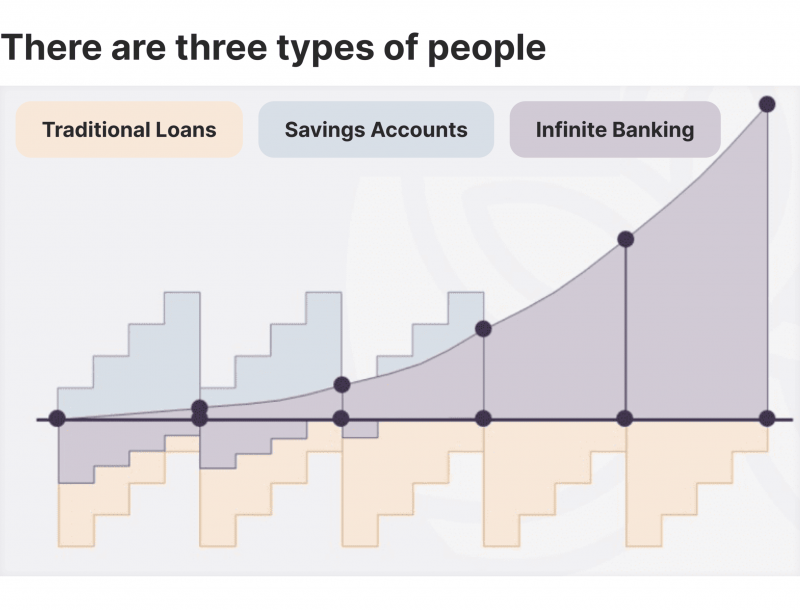

The approach has its own advantages, but it likewise has issues with high fees, intricacy, and extra, resulting in it being considered a scam by some. Limitless financial is not the very best policy if you require only the financial investment element. The infinite financial idea revolves around using entire life insurance policy plans as an economic device.

A PUAR allows you to "overfund" your insurance coverage right approximately line of it ending up being a Customized Endowment Agreement (MEC). When you make use of a PUAR, you quickly boost your money value (and your death advantage), consequently raising the power of your "financial institution". Additionally, the even more cash money value you have, the higher your interest and reward payments from your insurance policy firm will be.

With the increase of TikTok as an information-sharing system, monetary advice and methods have discovered a novel means of spreading. One such method that has been making the rounds is the infinite financial idea, or IBC for brief, gathering recommendations from stars like rapper Waka Flocka Flame - Financial independence through Infinite Banking. However, while the approach is currently preferred, its roots trace back to the 1980s when economist Nelson Nash introduced it to the world.

Can anyone benefit from Borrowing Against Cash Value?

Within these plans, the cash money value grows based upon a price established by the insurance company. Once a considerable cash money value collects, policyholders can obtain a cash worth financing. These finances differ from standard ones, with life insurance coverage serving as security, meaning one can lose their insurance coverage if borrowing exceedingly without ample cash worth to support the insurance policy prices.

And while the appeal of these plans is evident, there are natural restrictions and threats, necessitating diligent cash worth surveillance. The method's authenticity isn't black and white. For high-net-worth people or business owners, specifically those making use of methods like company-owned life insurance policy (COLI), the advantages of tax breaks and substance growth can be appealing.

The allure of infinite banking does not negate its obstacles: Expense: The foundational need, a permanent life insurance policy policy, is more expensive than its term counterparts. Qualification: Not every person gets entire life insurance coverage as a result of rigorous underwriting procedures that can exclude those with certain health or way of living conditions. Complexity and danger: The intricate nature of IBC, coupled with its dangers, may prevent several, particularly when simpler and much less risky alternatives are offered.

What are the risks of using Infinite Banking Concept?

Alloting around 10% of your regular monthly income to the plan is just not viable for most people. Part of what you read below is merely a reiteration of what has currently been claimed over.

So prior to you get on your own into a scenario you're not gotten ready for, understand the following initially: Although the principle is typically sold as such, you're not really taking a financing from yourself. If that were the instance, you wouldn't need to settle it. Rather, you're borrowing from the insurance provider and need to repay it with rate of interest.

Some social media posts recommend using cash worth from whole life insurance coverage to pay down credit rating card financial debt. When you pay back the finance, a portion of that interest goes to the insurance coverage company.

How secure is my money with Tax-free Income With Infinite Banking?

For the very first a number of years, you'll be paying off the commission. This makes it extremely hard for your plan to build up worth throughout this time. Unless you can pay for to pay a couple of to several hundred bucks for the following years or more, IBC will not work for you.

Not every person needs to rely only on themselves for monetary safety and security. Privatized banking system. If you need life insurance policy, here are some valuable pointers to consider: Take into consideration term life insurance policy. These plans supply insurance coverage throughout years with considerable economic commitments, like mortgages, trainee loans, or when caring for young youngsters. Make sure to look around for the best rate.

What financial goals can I achieve with Policy Loans?

Imagine never ever having to bother with financial institution loans or high passion prices once more. Suppose you could borrow cash on your terms and develop riches concurrently? That's the power of limitless banking life insurance policy. By leveraging the money worth of entire life insurance policy IUL plans, you can expand your wealth and borrow money without counting on traditional financial institutions.

There's no set lending term, and you have the liberty to pick the payment routine, which can be as leisurely as paying back the lending at the time of fatality. This flexibility reaches the maintenance of the lendings, where you can choose interest-only settlements, keeping the car loan balance level and manageable.

Can anyone benefit from Infinite Banking For Retirement?

Holding cash in an IUL fixed account being credited passion can usually be better than holding the cash money on deposit at a bank.: You have actually always imagined opening your very own pastry shop. You can borrow from your IUL plan to cover the initial costs of renting out a space, buying equipment, and hiring staff.

Individual lendings can be gotten from traditional banks and credit rating unions. Obtaining money on a credit report card is normally extremely costly with annual percent prices of rate of interest (APR) frequently getting to 20% to 30% or more a year.

Latest Posts

How To Train Yourself To Financial Freedom In 5 Steps

Whole Life Insurance Banking

Non Direct Recognition Whole Life Insurance